Have you recently opened your post to find a letter from PO Box 61301 London N17 1DR and wondered who sent it? You are not alone, as many people across the UK have received similar correspondence and been left puzzled or even worried.

Understanding the origin of such letters is essential to avoid unnecessary anxiety and to take the correct action if needed.

This blog will guide you through everything you need to know about this PO Box address, who uses it, why you might be contacted, and how to respond effectively. By the end, you will feel informed, confident, and ready to handle any mail arriving from PO Box 61301.

Who Uses PO Box 61301 London N17 1DR?

Before diving into details, let us first understand who operates behind PO Box 61301 London N17 1DR. This address is linked to PRA Group UK, a well-known debt collection agency operating across the United Kingdom.

They use this PO Box as their official mailing address for sending debt collection letters, statements, and related financial notices.

PRA Group specialises in acquiring non-performing debts, meaning debts that have been defaulted or left unpaid by consumers over time. Once they purchase these debts from lenders, they take over the responsibility of recovering the money owed.

It is essential to note that while PRA Group operates under this PO Box, no other unrelated businesses or organisations typically use it.

Receiving a letter from this address usually signifies that PRA Group has an active or historical interest in a financial matter related to you, making it important not to ignore or dismiss such mail.

Who Is PRA Group UK and What Do They Do?

To understand the role of PO Box 61301, we need to understand PRA Group UK. PRA Group is a leading debt collection company that operates across various regions, focusing mainly on buying and managing debt portfolios.

Their main activities include:

- Purchasing overdue consumer debts from banks, credit card companies, and utility providers.

- Attempting to recover these debts by contacting the debtor via mail, phone, or text.

- Offering payment plans or settlements to help consumers repay debts over time.

- Reporting payments or defaults to credit reference agencies.

In simple terms, PRA Group steps in when an original creditor decides to sell off unpaid debts. Instead of owing the original company, the debt is now owed to PRA Group.

They then manage the collection process following UK regulations, including providing the debtor with accurate information, offering flexible payment options, and ensuring fair treatment. Their mission revolves around debt recovery, but they must operate transparently and legally.

Why Did You Receive a Letter from PO Box 61301 London N17 1DR?

If you have received a letter from this PO Box, there are several possible reasons behind it. Here’s why you might have been contacted:

- Outstanding Debts: You may have an unpaid credit card, loan, or utility account.

- Purchased Debt: The debt was sold by your original lender to PRA Group.

- Mistaken Identity: Sometimes, letters are sent to the wrong person due to outdated or incorrect information.

- Old Accounts: Even debts from years ago can resurface if they remain unpaid.

It is crucial to read the letter carefully and check if the details match your records. Look for account numbers, dates, and amounts to determine if the debt is legitimate.

If you genuinely believe the debt is not yours, you have the right to request proof from PRA Group. Ignoring the letter can lead to further action, so it’s always better to clarify matters early.

Is Mail from PO Box 61301 London N17 1DR a Scam or Legitimate?

One of the biggest concerns when receiving mail from unknown addresses is whether it’s a scam. Letters from PO Box 61301 London N17 1DR are typically legitimate, as they come from PRA Group UK, a regulated debt collection agency.

However, scams do exist, and fraudsters can sometimes mimic real companies. To verify the authenticity of the letter, check the official contact details inside.

PRA Group provides specific phone numbers, SMS lines, and an official email. If anything seems suspicious, do not use the contact details in the letter but instead visit their official website to cross-check.

Being cautious and verifying legitimacy protects you from potential fraud while ensuring you address real financial matters.

What Should You Do If You Receive a Letter from PRA Group?

Receiving such a letter can be unsettling, but knowing how to respond makes all the difference. Many people panic or ignore the letter, but that can make matters worse.

Taking clear, informed steps will help you manage the situation calmly and possibly prevent further issues like legal action.

Review the Details

Carefully read through the letter and note down the account number, amount owed, and reason for the debt. Compare it with your personal records, such as bank statements or credit reports, to see if it matches.

Verify the Debt

If you are unsure about the debt’s legitimacy, you can request a copy of the original agreement or a full statement from PRA Group. They are legally required to provide you with this information, which will help you confirm if the debt is accurate.

Seek Professional Help

If the debt is valid but you are struggling to repay, reach out to a debt adviser or charity. They can help you explore your options, including setting up a repayment plan or considering a debt relief solution.

Contact PRA Group

Engage with PRA Group directly to discuss payment plans or dispute the debt if necessary. Remember, ignoring the letter will not make the problem go away and can lead to further collection efforts or legal action.

How Can You Contact PRA Group UK?

PRA Group offers several official channels to reach them, ensuring you can get in touch in the way that suits you best. It’s essential to contact them directly using these verified methods to avoid potential scams or miscommunication.

| Contact Method | Details |

| Phone | 0808 196 5550 (Mon-Thu: 8am-8pm, Fri: 9am-5pm, Sat: 8am-2pm) |

| SMS (Text Only) | 07860 094994 (standard SMS network charges apply, text only) |

| enquiries@pragroup.co.uk |

When reaching out, have your account or reference number on hand to help the customer service team locate your file quickly. PRA Group’s team can help with payment arrangements, disputes, or general questions.

Always keep a record of your communication, including dates, names of representatives, and any promises or agreements made during your contact.

How Does the UK Debt Collection Process Work?

The UK has a well-defined debt collection process regulated by the Financial Conduct Authority (FCA), which sets strict rules for debt collectors like PRA Group.

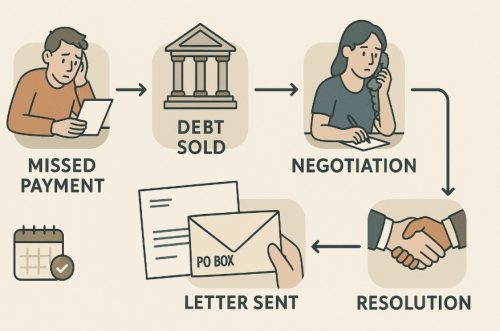

It typically starts when an individual falls behind on payments to their lender. The lender will often attempt to recover the debt directly by sending reminders or making calls.

If the debt remains unpaid, the lender may decide to sell it to a third-party collection agency, such as PRA Group. Once PRA Group owns the debt, they will attempt to recover the balance through letters, phone calls, or text messages.

Consumers have important rights:

- You can request a breakdown of the debt.

- You can dispute any part of it.

- You can propose a repayment plan.

Importantly, debt collectors must not harass, mislead, or apply unfair pressure, and they must follow the FCA’s fair treatment guidelines.

Can You Dispute or Negotiate a Debt with PRA Group?

Yes, you absolutely can dispute or negotiate a debt, and doing so is often the smartest approach. If you believe the debt is incorrect, you can send PRA Group a written request asking for proof of the debt and how the balance was calculated. They are legally obliged to provide this before continuing collection efforts.

If the debt is valid but you are facing financial hardship, you can:

- Request a repayment plan that fits your budget.

- Offer a settlement to pay part of the debt as a full and final payment.

- Work with a debt adviser who can communicate on your behalf.

Avoid ignoring the situation, as that can result in escalation, including legal action. Taking a proactive approach shows good faith and can often lead to more manageable solutions.

How to Protect Yourself from Unfair Debt Collection Practices?

Knowing your rights is key when dealing with any debt collector, including PRA Group. Debt collectors must follow clear rules under the FCA, and you have several protections under UK law.

Here’s how to protect yourself:

- Know Your Rights: Debt collectors must treat you fairly, without harassment or deception.

- Keep Records: Save all letters, emails, and make notes of any phone calls, including dates and names.

- Request Proof: Never pay a debt you do not recognise without seeing evidence of what you owe.

- Seek Advice: Contact free debt advice organisations if you’re unsure how to handle communications.

- Report Misconduct: If a collector harasses or misleads you, report them to the FCA or Financial Ombudsman.

By staying informed and proactive, you can handle debt collection situations confidently and safely. You are entitled to fair treatment, clear communication, and time to consider your options.

Conclusion

Receiving a letter from PO Box 61301 London N17 1DR can be stressful, but understanding who PRA Group is and why they’re contacting you helps reduce that anxiety.

By taking time to read, verify, and address the letter’s content, you protect your financial standing and ensure that any disputes or repayments are handled properly. Always remember that you have rights, and help is available if you need it.

Whether it’s a legitimate debt or a misunderstanding, acting promptly and knowledgeably is always your best option.

FAQs About PO Box 61301 London N17 1DR

What types of debt does PRA Group typically collect in the UK?

They usually collect credit card debts, loans, utility bills, and old overdrafts.

How long can a debt collector chase a debt in the UK?

Most debts become statute-barred after six years if no action or payment is made.

Will ignoring letters from PRA Group affect my credit score?

Yes, ignoring them can lead to defaults or legal action that harms your credit score.

Can PRA Group take me to court for unpaid debts?

If negotiations fail, they have the right to pursue court action to recover debts.

How do I find out if a debt has been sold to PRA Group?

You can check your credit report or request confirmation from PRA Group directly.

Is it safe to pay PRA Group directly or should I go through a debt advisor?

It is safe to pay them directly, but a debt advisor can help you negotiate better terms.

What should I do if PRA Group contacts me by mistake?

Inform them immediately, provide proof if needed, and ask them to correct their records.