Is the UK government doing enough to protect the financial well-being of its elderly population? One key policy at the heart of this debate is the triple lock on pensions. Introduced over a decade ago, it promises annual increases in the State Pension to keep pace with the cost of living.

However, with rising public debt and a growing number of pensioners, many experts now question whether this policy can be maintained indefinitely.

In this blog, we will break down what the triple lock is, how it works, why it matters, and what its future could look like.

What is Triple Lock Pension?

The triple lock is a UK government policy designed to protect the real value of the State Pension by ensuring it rises annually in line with the highest of three indicators: inflation (measured by the Consumer Prices Index), average wage growth, or a fixed minimum of 2.5%.

Introduced in 2011, it applies to both the basic State Pension (for those who retired before April 2016) and the new flat-rate State Pension (for those retiring after that date).

This policy was introduced to prevent pensioner income from falling behind the cost of living or earnings growth. For example, if wages grow faster than inflation, pensioners receive a wage-linked increase.

If inflation is higher, the pension is adjusted accordingly. In years when both figures are low, the 2.5% safeguard ensures there’s still a minimum increase. This approach protects pensioners against income stagnation while offering stability.

While the triple lock provides consistent annual increases, its financial burden on the government has been growing, making it a topic of continued political and economic debate.

Why Was the State Pension Triple Lock Introduced in the UK?

The State Pension triple lock was introduced to protect the income of UK pensioners and ensure their payments kept pace with the cost of living. Here’s why it was brought in and the impact it has had since 2011:

Addressing Pensioner Poverty

Before 2011, State Pensions typically rose in line with inflation alone. This meant that when inflation was low but wages rose, pensioners’ income effectively shrank in comparison to the working population.

This system contributed to financial difficulties among older people, leading to increased pensioner poverty.

A Fairer Approach to Retirement Security

The triple lock was introduced by the Conservative, Liberal Democrat coalition in 2011. The aim was to offer a fairer and more reliable way to maintain the value of the State Pension.

By including wage growth and a minimum 2.5% baseline, the government sought to reflect both economic performance and minimum protection against stagnation.

Political and Social Support

The introduction of the triple lock also responded to political pressure from pensioner groups and advocacy organisations.

It gained strong public support because it reassured older citizens that their income in retirement would not erode over time, restoring public trust in the pension system.

How Does the Triple Lock Guarantee Pension Increases?

The triple lock operates by comparing three economic indicators from the previous year and choosing the highest to determine the State Pension increase from the following April. These three indicators are:

- Consumer Prices Index (CPI): Measures inflation in September of the previous year.

- Average Earnings Growth: Calculated from UK wage data (May to July of the previous year).

- 2.5% Minimum Guarantee: Ensures pensioners receive at least a 2.5% rise, even if inflation and earnings growth are lower.

For example, if inflation is 1.7%, wages rise by 4.1%, and the fixed floor is 2.5%, then pensions increase by 4.1%. This ensures retirees’ incomes grow in line with economic conditions or at least don’t fall behind.

This guarantee is applied automatically by the government, and pensioners don’t need to take any action. It creates a dependable and transparent structure for retirement planning. The triple lock not only provides year-on-year protection but also boosts confidence in the long-term value of the State Pension.

What Is the Current Value of the State Pension and Who Qualifies?

The State Pension remains a cornerstone of retirement income for millions across the UK. Understanding the current rates and who qualifies is essential for future planning.

2025 State Pension Rates

- New Flat-Rate State Pension: £230.25 per week (approximately £11,973 per year)

- Old Basic State Pension: £176.45 per week (around £9,175 per year)

These are paid every four weeks and automatically adjusted based on the triple lock mechanism.

Eligibility Requirements

To qualify for the State Pension:

- At least 10 years of National Insurance (NI) contributions or credits are required to receive any pension.

- 35 qualifying years are needed for the full new State Pension.

- Contributions can come from:

- Regular employment

- NI credits (e.g. for unemployment, illness, or caring responsibilities)

- Voluntary contributions to make up for missed years

The type of pension received depends on when a person reaches the State Pension age, those who reached it before 6 April 2016 fall under the old system, while those after qualify for the new flat-rate system.

The State Pension is not affected by income or savings, making it a vital component of retirement income for millions in the UK.

How Much Has the Triple Lock Increased State Pensions in 2025?

In April 2025, the triple lock resulted in a 4.1% increase in the State Pension, based on the average earnings growth between May and July 2024.

The Consumer Prices Index was recorded at 1.7% during the same period, so the higher wage figure was used. This raised the full new State Pension to £230.25 per week, an annual increase of £472.

Meanwhile, the old basic State Pension rose to £176.45 per week, a gain of £363 per year. This increment ensured that pensioners retained their spending power amid modest inflation.

How Has the Triple Lock Affected the UK Pension System Over Time?

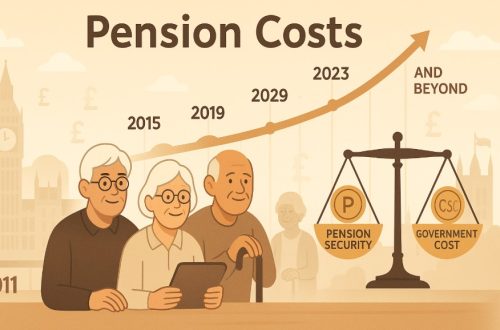

The triple lock has played a critical role in increasing pensioner incomes but also in raising the government’s overall pension bill.

Key Outcomes:

- Helped lift many older people out of poverty

- Improved pensioner incomes at a faster rate than inflation

- Created a predictable, rules-based framework for pension increases

However, it has also contributed to a sharp rise in the overall cost of State Pensions.

Government Spending Growth:

| Year | Annual State Pension Spending | % of UK GDP |

| 2011 | £66 billion | 3.7% |

| 2025 | £138 billion | 5% |

| 2030 | £153.5 billion (projected) | 6–7% |

The Office for Budget Responsibility (OBR) now warns that spending on the State Pension could become unsustainable if triple lock costs continue to rise. Despite its social benefits, it has become one of the fastest-growing areas of government expenditure.

Will the State Pension Triple Lock Be Maintained in the Future?

The government has pledged to maintain the triple lock until the end of the current Parliament. However, with the OBR forecasting its annual cost to reach £15.5 billion by 2030, many experts argue it is becoming financially untenable.

Proposed alternatives include shifting to a double lock (based on inflation or earnings) or linking pension increases to average earnings alone.

Although politically sensitive, reform may be necessary to ensure long-term fiscal responsibility. Any future changes would li…

What Happens If the Government Suspends the Triple Lock?

In 2022, the triple lock was suspended due to anomalous wage growth during the COVID-19 recovery. The government used the CPI inflation rate to adjust pensions instead, leading to a lower increase than would have occurred under the triple lock.

Likely Outcomes of a Suspension:

- Smaller annual pension increases

- Reduced pensioner purchasing power

- Long-term income losses

- Increased political backlash and public concern

Potential Replacement Options:

- Double Lock: Highest of inflation or wages

- Single Lock: Inflation only

- Discretionary Model: Set by the Chancellor annually

Each of these models reduces government expenditure but also weakens the predictability and generosity of pension increases.

A suspended or replaced triple lock would fundamentally change the pension landscape and could lead to increased hardship among low-income pensioners.

How Does Triple Lock Compare to Other Pension Uplift Methods?

When examining global alternatives or previous UK models, the triple lock stands out for its generous protection.

| Method | Adjustment Basis | Benefits | Drawbacks |

| Triple Lock | Inflation, earnings, or 2.5% | Strongest safeguard for retirees | Costly for the government |

| Double Lock | Inflation or earnings | Balanced protection and affordability | Less growth during low inflation |

| Single Lock | Inflation only | Budget-friendly and predictable | Fails to keep pace with wages |

| Discretionary | Set annually by government | Offers flexibility in tough times | Uncertainty for pensioners |

While other systems may be cheaper, the triple lock offers unmatched security and has become a defining feature of UK retirement policy.

Is the Triple Lock Sustainable for Future Generations?

The sustainability of the State Pension triple lock is under growing scrutiny. With an ageing population, rising life expectancy, and slow productivity growth, pension costs are projected to reach 7.7% of GDP by the 2070s, up from 5% today.

This puts pressure on public finances, potentially leading to higher taxes, delayed retirement, or reduced public services for future generations. Fewer workers supporting more retirees could unbalance the system, while borrowing may rise without fiscal reforms.

Some experts propose linking pensions solely to earnings or adopting a double lock. Others suggest increasing the State Pension age gradually. While the triple lock has helped protect pensioners’ living standards, sustaining it long-term will require bold policy choices.

The government must balance fairness for current retirees with financial responsibility for younger taxpayers, making reform essential for the future of UK pensions.

Conclusion

The triple lock on State Pensions plays a vital role in preserving the income and dignity of millions of UK pensioners. It offers a dependable safety net that adjusts for inflation, wage growth, and economic uncertainty.

However, the rising cost of this policy, projected to reach £15.5 billion annually by 2030, raises serious questions about its sustainability.

As political, financial, and demographic pressures mount, the UK must find a balanced path forward that secures pensioners’ futures without overburdening the next generation.

FAQs About Triple Lock on Pension

How is the state pension funded and how does it affect the economy?

The State Pension is primarily funded through National Insurance contributions from current workers. Rising costs place strain on public finances and increase national debt.

Can pensioners increase their payments through voluntary contributions?

Yes, pensioners can make voluntary National Insurance contributions to fill gaps in their records. This can help them qualify for a higher pension amount.

Does living abroad affect eligibility for the triple lock pension?

If you live abroad, your eligibility depends on the country of residence. Some countries outside the UK receive annual increases, others do not.

What is the difference between basic and new state pension?

The basic pension applies to those who reached pension age before 2016, while the new State Pension applies after. The new scheme generally pays more and simplifies entitlements.

How does inflation volatility impact triple lock calculations?

Volatile inflation can trigger significant pension increases under the triple lock. This leads to unpredictable costs for the government.

Is pension credit available alongside the state pension?

Yes, eligible pensioners can receive Pension Credit as a top-up to their State Pension. It also opens access to additional benefits like council tax reductions.

Will rising life expectancy influence the pension system further?

Yes, increasing life expectancy puts added pressure on pension costs. Future reforms may include raising the retirement age to ensure sustainability.