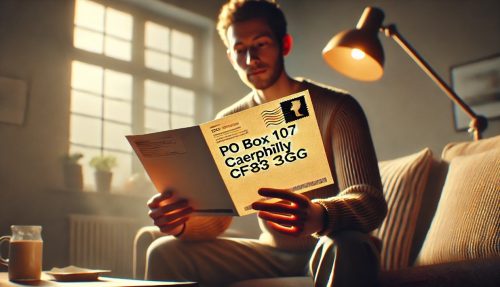

Have you received a letter from PO Box 107 Caerphilly CF83 3GG and wondered who it is from? Many individuals across the UK receive correspondence from this address, often leading to confusion and concern.

If you’ve received correspondence from them, verify the debt’s legitimacy before taking any action. You have legal rights when dealing with debt collectors in the UK, including requesting proof of debt and negotiating payment options.

In this article, we will explore who uses PO Box 107 Caerphilly CF83 3GG, why you may have received mail from this address, and what your rights are when dealing with debt collectors in the UK.

Understanding this information can help you take the right steps in handling any communication from them.

Who Uses PO Box 107 Caerphilly CF83 3GG?

PO Box 107 Caerphilly CF83 3GG is primarily used for mail correspondence by Link Financial Outsourcing, a debt collection agency operating across the UK and Europe.

Companies like Link Financial use PO Boxes instead of physical office addresses for efficiency, security, and to manage high volumes of correspondence.

A PO Box allows them to centralise communication, ensuring a streamlined process for handling debt-related notices.

While Link Financial is the main organisation associated with this address, other businesses may also use similar PO Boxes in Caerphilly.

If you receive a letter from this address, it is likely related to debt collection.

Who Is Link Financial Outsourcing?

Link Financial Outsourcing is a debt collection agency that operates in the UK and several European countries.

Their primary role is to purchase and manage unpaid debts from banks, credit card providers, loan companies, and other financial institutions.

Once a debt is sold to Link Financial, they become the legal owner of the outstanding balance and take responsibility for collecting payments.

They typically contact individuals through letters, emails, or phone calls, informing them of the debt and requesting repayment.

What Do They Do?

Key services of Link Financial Outsourcing include:

- Debt Collection: Recovering overdue payments on behalf of financial institutions.

- Debt Purchasing: Buying unpaid debts from banks and lenders at a reduced cost.

- Debt Management: Offering repayment plans to help individuals clear their debts.

Link Financial is regulated by the Financial Conduct Authority (FCA), ensuring that their debt collection practices adhere to UK legal standards.

If you have received a letter from them, it is important to understand your rights and options before responding.

Why Did You Receive a Mail from PO Box 107 Caerphilly CF83 3GG?

If you have received a letter from PO Box 107 Caerphilly CF83 3GG, it is most likely from Link Financial Outsourcing regarding an outstanding debt.

This company specialises in debt collection and may have contacted you for several reasons.

Purchased Debt Accounts

Your bank or lender may have sold your unpaid debt account to Link Financial, making them responsible for collecting payments.

Debt Collection Services Provider

A company you previously had an account with may have hired Link Financial to recover overdue payments and outstanding balances.

Structured Repayment Plans

If you are on a structured repayment plan, Link Financial might be managing your debt recovery to ensure timely payments.

Disputed Debt Issues

They could be reaching out to clarify or resolve an ongoing dispute regarding an unsettled debt linked to your financial history.

General Account Review Process

You may have an old or inactive financial account with outstanding balances requiring further debt action.

If you receive such a letter, don’t ignore it. Verify the debt details and understand your rights before taking any action.

Is Link Financial Outsourcing a Legitimate Company?

Yes, Link Financial Outsourcing is a legitimate debt collection agency operating in the UK and Europe.

They are regulated by the Financial Conduct Authority (FCA), which ensures that they follow fair and ethical debt collection practices.

While Link Financial is a legitimate company, many people report concerns about their debt collection methods.

Some individuals have received letters for debts they do not recognise. If you believe there is an error, you have the right to dispute the debt.

How to Verify Link Financial Outsourcing Legitimacy?

- Check the FCA Register: Link Financial is listed under FCA regulations.

- Review Official Correspondence: Ensure letters contain accurate details.

- Contact the Original Creditor: Confirm that your debt was transferred to Link Financial.

What Should You Do If You Receive a Letter from This Address?

Receiving a letter from PO Box 107 Caerphilly CF83 3GG can be concerning, especially if you do not recognise the sender or the debt being referenced.

However, it is essential to address the situation appropriately to avoid unnecessary complications. What are the steps to take:

Do Not Ignore It

Many people assume that ignoring a debt collection letter will make it go away. However, this can lead to further action, including legal proceedings.

Verify the Debt

Always request written proof that the debt belongs to you. The debt collection agency should provide details such as the original lender, the amount owed, and a breakdown of charges.

Check if the Debt is Statute-Barred

In the UK, debts become unenforceable if the lender has not taken legal action within six years. If the debt is statute-barred, you may not be legally required to pay it.

Contact a Financial Advisor

Free financial advice services, can help you understand your rights, verify debts, and explore repayment options, and ensure you handle debt collection confidently.

By following these steps, you can handle the situation legally and responsibly, ensuring that you only pay debts that are valid and enforceable.

Can Link Financial Take Legal Action Against You?

Yes, Link Financial Outsourcing has the legal right to take action against individuals who owe outstanding debts.

However, this usually happens after multiple attempts to contact you and request repayment. Ignoring their letters or phone calls could escalate the situation. Here are the possible legal actions:

County Court Judgments (CCJs)

A CCJ is a court order that legally requires you to repay a debt. If a CCJ is issued, it can negatively impact your credit score for six years, making it harder to borrow money in the future.

Wage Deductions

If you do not respond to a CCJ, the court can issue an attachment of earnings order, which deducts money directly from your salary.

Bailiff Action

In extreme cases, bailiffs may be sent to recover the debt. This can result in the seizure of personal belongings to cover the outstanding amount.

If you receive a court claim form from Link Financial, do not ignore it. You have the right to dispute the debt if it is incorrect or arrange a repayment plan if you are unable to pay the full amount immediately.

Seeking professional financial advice can help you understand your options and avoid unnecessary legal action.

How Can You Contact Link Financial Outsourcing?

If you need to verify a debt, request documentation, or dispute a claim, contacting Link Financial Outsourcing directly is the best approach.

They offer multiple ways to get in touch, allowing you to discuss your situation and find a suitable resolution.

Link Financial Contact Details

- Website: www.linkfinancial.eu – You can find their official contact form and further details about their services.

- Email: info@linkfinancial.co.uk – Send written requests for proof of debt or repayment queries.

- Phone: 03330 145 145 – Call to speak with a representative regarding your debt or repayment options.

- Postal Address: Link Financial Outsourcing, PO Box 107, Caerphilly, CF83 3GG – Use this address to send written correspondence, such as formal debt disputes.

- Additional Address: 5 The Peak, Wilton Rd, Pimlico, London SW1V 1AN – Another contact address for correspondence.

Important Considerations

- Always keep records of any communication with Link Financial, including emails and letters.

- Be cautious of scam calls or fraudulent debt collection letters. Always verify that the correspondence is genuinely from Link Financial before making any payments.

- If you feel pressured or mistreated, you have the right to file a complaint with the Financial Ombudsman Service (FOS).

What Are the Common Complaints About Link Financial?

Like many debt collection agencies, Link Financial Outsourcing has received complaints from individuals who claim to have experienced unfair or aggressive collection tactics.

Many of these complaints are shared on platforms such as Trustpilot and other legitimate forums.

Common Complaints Include

- Letters for Unrecognised Debts: Some people claim they received letters regarding debts they never took out or had already paid off.

- Difficulties in Reaching Customer Service: Many users report long wait times and poor communication when trying to resolve disputes.

- Persistent Calls and Letters: Some individuals feel overwhelmed by the frequent contact from Link Financial, even when they have requested proof of the debt.

How to Handle Complaints?

- If you believe Link Financial has misrepresented a debt, request a “Prove the Debt” letter.

- If you are being harassed with excessive calls or letters, you can formally request that they communicate only in writing.

- If Link Financial fails to resolve your complaint, you can escalate the matter to the Financial Ombudsman Service (FOS), which investigates unfair financial practices.

Can You Dispute a Debt from Link Financial?

Yes, if you believe the debt is incorrect or not legally enforceable, you have the right to dispute it.

Debt collection agencies must provide clear evidence that the debt is valid and belongs to you before requesting payment. Here how to dispute a debt:

Request Proof of Debt

- Send a written request asking Link Financial for official documentation that proves the debt is yours.

Check for Errors

- Ensure that the debt amount, account details, and dates match your financial records.

Challenge Unfair Charges

- If the debt includes excessive fees, you can dispute these with the Financial Ombudsman.

Seek Legal Advice

- If Link Financial does not provide sufficient proof, you can escalate the dispute to Citizens Advice or StepChange.

Disputing a debt is your legal right, and Link Financial cannot force payment without valid evidence.

What Are Your Rights When Dealing with Debt Collectors in the UK?

In the UK, debt collectors like Link Financial Outsourcing must follow strict rules set by the Financial Conduct Authority (FCA).

Understanding your rights can help you deal with their collection attempts fairly and legally.

Your Rights as a Debtor

- Right to Request Written Communication: You can ask debt collectors to contact you only in writing instead of phone calls.

- Right to Dispute an Unverified Debt: A debt collector must provide proof before requesting payment.

- Right to Fair Treatment: They cannot use aggressive or misleading tactics to pressure you into paying.

- Right to Financial Assistance: If you cannot afford to pay, charities like StepChange and National Debtline can help you set up a fair repayment plan.

- Right to Protection from Harassment: If a debt collector harasses or threatens you, you can report them to the Financial Ombudsman Service (FOS).

Knowing your rights ensures that you do not fall victim to unfair collection tactics and can respond confidently to any debt claims.

Conclusion

Receiving a letter from PO Box 107 Caerphilly CF83 3GG can be unsettling, but it’s important to handle it carefully.

Since Link Financial Outsourcing primarily uses this address, the letter likely concerns an outstanding debt. However, not all debts are enforceable, and errors can occur.

Before making any payments, verify the debt, request proof, and understand your rights. If unsure, seek advice from StepChange, National Debtline, or Citizens Advice.

Debt collectors must follow FCA guidelines and cannot harass or mislead you. If treated unfairly, you have the right to dispute the debt and escalate complaints.

FAQs About PO Box 107 Caerphilly CF83 3GG

Is PO Box 107 Caerphilly CF83 3GG only used by Link Financial?

No, but Link Financial is the most well-known company associated with this address. Other financial services may also use similar PO Boxes in the area.

How do I check if a debt from Link Financial is real?

You can request a Prove the Debt letter, which requires them to provide documentation showing they own the debt and that you are responsible for it.

What happens if I ignore letters from Link Financial?

Ignoring letters may lead to further collection attempts, a negative impact on your credit score, or in some cases, legal action.

Can Link Financial send bailiffs to my home?

No, debt collectors like Link Financial do not have the same powers as bailiffs. However, they may take court action, which could eventually lead to bailiff involvement if a CCJ (County Court Judgment) is issued.

How can I stop Link Financial from contacting me?

You can formally request that they communicate only in writing. However, this does not mean the debt goes away—it just changes how they contact you.

Can I negotiate a lower repayment amount with Link Financial?

Yes, many debt collection agencies accept reduced settlement offers or payment plans if you are struggling financially.

How long can Link Financial chase a debt?

In England and Wales, most debts become statute-barred after 6 years if no payments or acknowledgments are made.

Can I write off my debt with Link Financial?

You may qualify for a Debt Relief Order (DRO), Individual Voluntary Arrangement (IVA), or bankruptcy, depending on your circumstances.