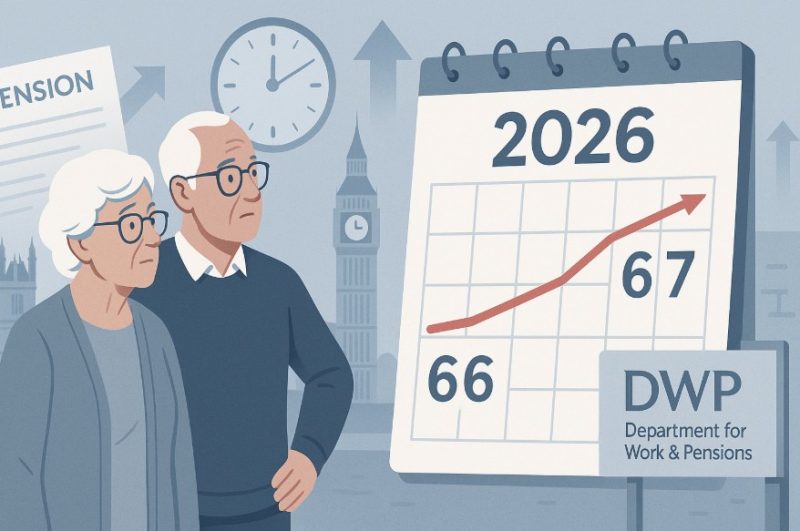

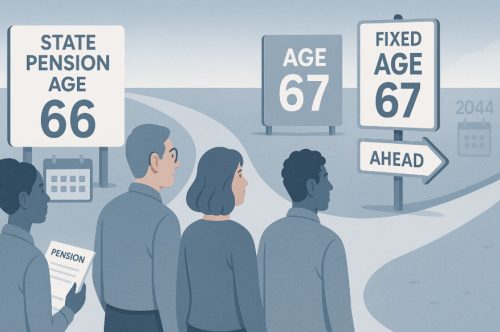

Is your retirement approaching sooner than you thought? If you were born after April 1960, changes confirmed by the Department for Work and Pensions (DWP) may delay when you receive your State Pension.

The UK government has announced a gradual increase in the State Pension age from 66 to 67, starting in 2026 and continuing through 2028. These alterations are part of a phased implementation that will affect millions.

This article breaks down what you need to know about these updates, who will be affected, and how the changes might influence your retirement planning and pension eligibility timeline.

What Is the 2026 State Pension Age Change Confirmed by the DWP?

The 2026 State Pension age change confirmed by the DWP marks a shift in when UK citizens can begin receiving their retirement benefits. Currently, men and women can claim the State Pension at age 66.

However, starting in 2026, the qualifying age will increase to 67. This adjustment is not being implemented overnight but will instead roll out gradually over a two-year period, concluding in 2028.

The DWP’s confirmation follows a legislative move under the Pensions Act 2014, which accelerated the change by eight years. Importantly, individuals won’t simply reach pension age on their 66th birthday.

Instead, depending on their birthdate, they’ll qualify at 66 years and a certain number of months. This phased delay aims to reflect increasing life expectancy and ensure long-term financial stability of the State Pension system.

Who Will Be Affected by the New Pension Age Rules from 2026?

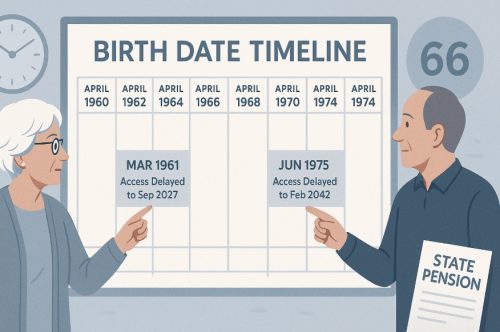

The changes primarily affect those born between 6 April 1960 and 5 March 1961. This group is referred to as the transition cohort, and they will no longer be eligible for the full State Pension exactly on their 66th birthday.

Instead, their eligibility will depend on the exact month and day they were born. This affects the retirement timelines of many individuals, delaying their expected payments and altering financial planning decisions.

Affected Individuals Include

- People born between 6 April 1960 and 5 March 1961

- Both men and women nearing the current State Pension age

- Workers planning to retire in 2026, 2027 or early 2028

- Citizens without private pensions relying entirely on the State Pension

State Pension Age by Birthdate

| Birthdate Range | New State Pension Age |

| 6 April 1960 – 5 May 1960 | 66 years and 1 month |

| 6 May 1960 – 5 June 1960 | 66 years and 2 months |

| 6 June 1960 – 5 July 1960 | 66 years and 3 months |

| 6 July 1960 – 5 August 1960 | 66 years and 4 months |

| 6 August 1960 – 5 September 1960 | 66 years and 5 months |

| 6 September 1960 – 5 October 1960 | 66 years and 6 months |

| 6 October 1960 – 5 November 1960 | 66 years and 7 months |

| 6 November 1960 – 5 December 1960 | 66 years and 8 months |

| 6 December 1960 – 5 January 1961 | 66 years and 9 months |

| 6 January 1961 – 5 February 1961 | 66 years and 10 months |

| 6 February 1961 – 5 March 1961 | 66 years and 11 months |

| 6 March 1961 – 5 April 1977 | 67 years |

When Will You Reach State Pension Age Based on Your Birth Date?

The date you become eligible for the State Pension after 2026 will depend directly on your exact birth date. Instead of a fixed age, individuals will now qualify at 66 years and an additional number of months, based on when they were born between April 1960 and March 1961.

This phased approach means that some individuals may only experience a one-month delay, while others may have to wait up to eleven months beyond their 66th birthday.

Anyone born on or after 6 March 1961 will need to wait until age 67 to access their State Pension in full. This timetable allows the government to gradually roll out the policy without overwhelming the retirement system.

How Long Will the Phased Pension Delay Last?

Understanding how long the phased State Pension age delay will last is crucial for those nearing retirement. The changes, starting in April 2026, aim to gradually raise the qualifying age over a 12-month period to ease the impact on individuals and ensure a smoother transition.

| Date of Birth | New Pension Age |

| 6 April – 30 April 1960 | 66 years and 1 month |

| May 1960 | 66 years and 2 months |

| June 1960 | 66 years and 3 months |

| July 1960 | 66 years and 4 months |

| August 1960 | 66 years and 5 months |

| September 1960 | 66 years and 6 months |

| October 1960 | 66 years and 7 months |

| November 1960 | 66 years and 8 months |

| December 1960 | 66 years and 9 months |

| January 1961 | 66 years and 10 months |

| February 1961 | 66 years and 11 months |

| 1 – 5 March 1961 | 66 years and 11 months |

This phased schedule helps prevent sudden changes to the pension system while allowing individuals time to adjust their retirement plans.

Though the increase is gradual, it can significantly affect when financial support begins for those depending on the State Pension. The government’s approach seeks to balance economic sustainability with fairness.

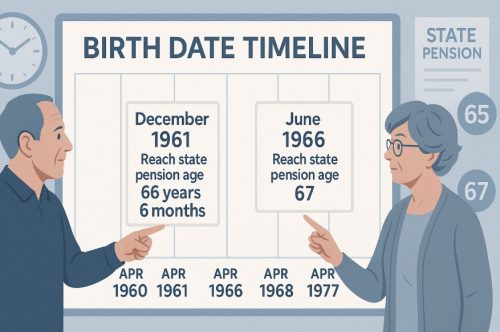

What Are the Exact Pension Ages for Each Birth Month in 1960-61?

The Department for Work and Pensions has provided a precise timetable for when individuals in the transition group will become eligible.

The change affects those born from 6 April 1960 to 5 March 1961, assigning them a pension age that adds additional months on top of their 66th birthday.

For example, someone born between:

- 6 April – 5 May 1960: State Pension age is 66 years and 1 month

- 6 May – 5 June 1960: 66 years and 2 months

- 6 June – 5 July 1960: 66 years and 3 months

- 6 July – 5 August 1960: 66 years and 4 months

- And so on until

- 6 February – 5 March 1961: 66 years and 11 months

Those born from 6 March 1961 to 5 April 1977 will have a fixed State Pension age of 67. This clear breakdown ensures that every affected individual knows precisely when they can expect their retirement benefits.

Why Is the State Pension Age Increasing in the UK Again?

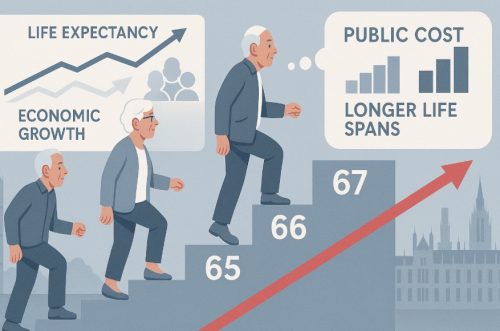

The UK government’s decision to increase the State Pension age once again is rooted in several key factors that affect the sustainability of public finances and the changing nature of society.

This increase was outlined in law through the Pensions Act 2014, and it reflects the broader demographic and financial challenges the country faces.

Rising Life Expectancy

One of the main reasons for the increase is that people in the UK are living longer. As life expectancy continues to rise, people are drawing their State Pension for more years than in previous decades. This puts extra pressure on government resources to fund retirements over extended periods.

Economic Sustainability

With fewer working-age people supporting a growing number of retirees, the cost of maintaining the current pension structure is becoming unsustainable.

By raising the pension age, the government aims to ensure that the system remains viable for future generations.

Policy Adjustments Over Time

The government is also committed to reviewing the State Pension age regularly. These reviews assess economic data, life expectancy trends, and public finances before making future policy changes.

How Does the State Pension Age Rise Affect Your Retirement Planning?

This upcoming change significantly alters how individuals in the transition group should approach their retirement planning.

Anyone born between 6 April 1960 and 5 March 1961 will face a delay in accessing their pension, which may impact budgeting, savings, and income planning.

Key effects on retirement planning include:

- Delayed access to funds: You may have to wait up to 11 months longer than expected for your pension.

- Extended working period: Individuals might need to stay employed longer or rely on other income sources.

- Increased pressure on private pensions: Personal pensions may be drawn earlier to bridge the gap caused by the delay.

- Financial forecasting becomes more complex: More precise retirement projections are required.

- Potential tax implications: Accessing other savings early may change your tax obligations.

Even though people will technically still reach eligibility at age 66, they won’t receive the payment on their birthday. This subtle but significant shift highlights the need for early and accurate retirement planning.

Individuals should revisit their financial strategies, consider increasing contributions to workplace or private pensions, and seek guidance from a qualified financial adviser to avoid income gaps and long-term shortfalls.

What Will Happen to People Born After March 5, 1961?

Those born after 5 March 1961 will face different rules than the transitional group. Their State Pension age will no longer depend on a sliding scale.

Instead, they will qualify for the full State Pension at the age of 67, without the “66 plus months” format. This removes any confusion or partial delays, but it also solidifies a longer wait.

The entire generation born between 6 March 1961 and 5 April 1977 will not benefit from the age 66 rule at all. Instead, they will need to reach the fixed age of 67 before receiving any State Pension payments.

This adjustment aligns with the broader national reform and further separates pre-2026 retirees from those affected by the new structure.

Are There Different Rules for Those Born After 1961?

Yes, the State Pension rules for people born after 5 March 1961 differ significantly from those in the transition phase. The phased model used for people born between April 1960 and March 1961 does not apply.

Instead, the State Pension age is set definitively at 67 years. There is no additional month-by-month increase or gradual implementation for this group. Whether you were born in March 1962 or April 1975, you will reach pension age at 67.

The government has made this simplification to standardise the retirement age for a broader population group and help with easier policy implementation. However, any future updates or adjustments will depend on national reviews and parliamentary approvals.

Will the Age Rise to 68 in the Future?

A future increase in the State Pension age to 68 is currently part of long-term government planning. Although not yet confirmed into law, it has been proposed that this change could take place between 2044 and 2046.

If enacted, this would affect individuals born after April 5, 1977. The potential shift reflects ongoing reviews of life expectancy and public pension affordability.

The government regularly evaluates the age based on demographic trends and economic conditions. While no immediate legislative changes have been made, the groundwork for this rise is already visible in policy discussions.

It is expected that future governments will continue these age adjustments to ensure the pension system remains financially sustainable for upcoming generations.

Conclusion

The upcoming changes to the State Pension age in 2026 mark a significant turning point in how UK citizens approach retirement.

The rise from 66 to 67, particularly the phased format for those born between April 1960 and March 1961, requires proactive financial planning.

While the changes aim to ensure a sustainable pension system, they also introduce complexity and potential challenges for individuals close to retirement. Understanding when you’ll qualify for your pension is more important than ever.

By staying informed, adjusting your plans, and seeking expert advice, you can navigate this transition confidently and prepare for a secure retirement.

Stay up to date with official benefit announcements and planning tools by visiting UK Benefits — your reliable guide through the UK welfare system.

FAQs About DWP 2026 State Pension Age Change

What’s the historical timeline of UK state pension age increases?

The UK state pension age has gradually increased from 60 (for women) and 65 (for men) to 66 for both, and now will reach 67 between 2026 and 2028.

Is it possible to receive pension payments early due to ill health?

While the State Pension cannot be accessed early, individuals with health issues may apply for other support like Employment and Support Allowance (ESA) or Personal Independence Payment (PIP).

What is the difference between state and private pensions during the transition?

State Pension follows government age rules, while private pensions may have flexible access ages, typically from age 55 or 57 depending on the scheme.

Will people be notified about their exact pension date?

Yes, the DWP will provide official pension age notifications, and individuals can also check using the Government’s online pension age calculator.

Are there protests or petitions against this state pension age rise?

While the 2026 change is confirmed, there are advocacy groups lobbying for fairness, particularly for those impacted in the transitional phase.

Does deferring the state pension increase the amount received?

Yes, deferring your state pension can increase your weekly payments slightly, depending on how long it is delayed and the rules in place at the time.

How do you appeal errors in pension age calculation?

If you believe there’s a miscalculation, you can contact the Pension Service or the Pensions Ombudsman for an investigation and correction.