Understanding how to report and pay Capital Gains Tax on UK property is vital for anyone disposing of residential real estate. With updated deadlines and digital reporting systems, failing to comply can result in penalties and interest.

Whether you’re a resident selling a second home or a non-resident landlord offloading property, knowing your obligations under HMRC rules is key.

This article walks you through who needs to pay, how to calculate your liability, when to report, and what allowances you may be entitled to. Staying informed ensures you remain compliant and avoid unnecessary fines.

What Is Capital Gains Tax, and Why Does It Apply to Property?

Capital Gains Tax (CGT) is a tax on the profit you make when selling or disposing of a property that has increased in value. The gain is the difference between the purchase price and the sale price, after deducting eligible expenses.

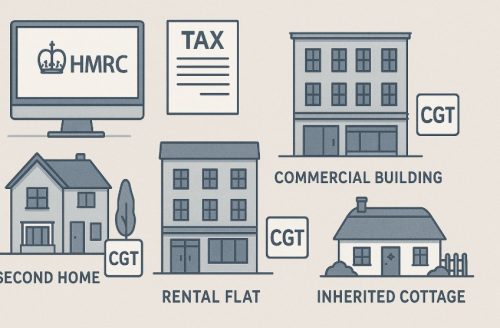

This tax applies to UK properties that are not your primary residence, such as second homes, rental properties, and inherited properties. HMRC enforces CGT to ensure fair contribution from property investments. You only pay tax on the gain, not the total sale price.

Key points to remember:

- CGT does not apply to your main residence if full relief is available.

- You must report within HMRC’s specified timeframes.

- Calculation involves deducting allowable costs and applying tax rates based on income.

Understanding CGT is essential for property owners to plan sales wisely and avoid unexpected tax liabilities.

Who Needs to Pay Capital Gains Tax When Selling UK Property?

You need to pay Capital Gains Tax if you’re selling or disposing of a UK property and it’s not fully covered by private residence relief. Both UK residents and non-residents are liable under certain conditions.

The tax is relevant whether you’re selling for a profit, gifting the property, or transferring it under certain legal arrangements.

Individuals who must pay:

- Property investors selling buy-to-let properties

- Owners of second homes

- Individuals inheriting and selling property at a profit

- Non-residents selling UK property

- Trusts and personal representatives of estates

You do not need to pay if:

- The gain is below the annual tax-free CGT allowance

- You’re selling your only or main residence and qualify for full Private Residence Relief

- You’re transferring the property to a spouse or civil partner under qualifying conditions

Each individual owner must report and pay their share of the gain separately. The rules also apply if the property is jointly owned.

What Types of UK Property Sales Are Taxable Under CGT?

Capital Gains Tax applies to several categories of property sales in the UK. If you’re disposing of a residential property that is not your main home, it is usually subject to CGT.

Similarly, the sale of commercial property or land may also be taxable. The circumstances and type of ownership affect whether CGT applies.

Types of Property Transactions and CGT Applicability

| Type of Property | CGT Applicable? | Notes |

| Main home (with full relief) | No | If fully covered under Private Residence Relief |

| Second homes | Yes | Gain from sale is taxable |

| Buy-to-let properties | Yes | CGT applies on sale after deducting expenses |

| Inherited property | Yes | Based on the gain from probate value |

| Gifted property (non-spouse) | Yes | Market value at time of gift used for CGT |

| Spouse or civil partner transfer | No | Transfer usually exempt |

| Commercial property | Yes | Taxed under different CGT rates |

By understanding which types of property sales are subject to CGT, UK property owners can better plan transactions and manage potential tax liabilities effectively.

How Is Capital Gains Tax on Property Calculated?

The calculation of CGT on UK property depends on how much profit you make from the sale and your income tax bracket.

You’ll start by identifying the gain, which is the difference between the sale proceeds and the acquisition cost, minus any allowable expenses.

Calculation steps:

- Determine the sale price (or market value if gifted)

- Subtract the purchase price

- Deduct eligible costs (e.g. stamp duty, legal fees, estate agent fees, improvement costs)

- Subtract the annual CGT allowance (£6,000 for 2024/25)

- Apply the correct CGT rate based on your income

Basic-rate taxpayers pay 18% on residential property gains, while higher-rate taxpayers pay 28%. For non-residential property, the rates are 10% and 20%, respectively.

How to Report and Pay Capital Gains Tax on UK Property?

Reporting and paying Capital Gains Tax (CGT) on UK property must be done through HMRC’s dedicated online system.

Whether you’re a UK resident or a non-resident, you are required to complete the process within 60 days of completing the property sale. This helps you avoid late payment penalties and interest.

Set Up a Capital Gains Tax Account

To begin, you need to access the HMRC portal using a Government Gateway ID. If you don’t already have one, you can create an account during the process. Once signed in, you’ll be prompted to create a Capital Gains Tax on UK property account, which is different from a standard tax account.

Collect Required Information

You’ll need several key details to complete your CGT report:

- The address and postcode of the property

- Dates of purchase, exchange, and completion

- Purchase and sale price

- Legal, agent, and improvement costs

- Reliefs or allowances being claimed

Report Your Gain

The online form requires you to input all financial details relating to the sale. Non-residents must complete the report even if no CGT is due, and everyone must attach accurate gain calculations.

Pay Your Tax

Once your report is submitted, HMRC issues a 14-character payment reference number. You can then pay via online banking, debit or credit card, or cheque. Payment must be completed within the 60-day timeframe to avoid late fees or interest.

Is There Allowances and Exemptions for Capital Gains Tax?

Yes, several exemptions and allowances can reduce your CGT liability. The most significant is the annual exempt amount, which is £6,000 for the 2024/25 tax year. If your total gains for the tax year fall below this threshold, you owe no CGT.

Other notable exemptions include Private Residence Relief, which applies if the property was your only or main home. You may also benefit from Lettings Relief if the property was let out during your ownership.

Spouses and civil partners can transfer property between each other tax-free, enabling strategic planning to use both CGT allowances.

What Happens If You Miss the Deadline for Reporting or Paying CGT?

Failing to report or pay CGT within HMRC’s 60-day window for property sales can lead to penalties and interest charges. This applies whether you’re a UK resident or non-resident.

Late Reporting

If you miss the reporting deadline, HMRC may charge:

- A fixed penalty for late filing

- Daily penalties if the return remains outstanding for several months

- Interest on the unpaid tax amount

Late Payment

If you report on time but don’t pay by the due date:

- Interest starts accruing from the day after the 60-day deadline

- Further penalties may apply if tax remains unpaid beyond 30 days

The longer you delay, the more you risk in additional charges. Always prepare in advance and report as soon as possible.

Are There Special CGT Rules for Non-Residents and Overseas Landlords?

Yes, non-residents have specific reporting duties, even if they owe no tax. If you’re not a UK resident and you dispose of a UK property on or after 6 April 2020, you must report the transaction within 60 days.

Non-residents must:

- Use the online CGT property account

- Report even if no tax is due

- Provide full details including sale and acquisition values

Tax is only due if there is a gain, but reporting is mandatory. Failure to comply results in penalties similar to UK residents. Non-residents are taxed only on UK land and property, not on gains from non-UK assets.

How Can You Reduce Your Capital Gains Tax Liability Legally?

You can reduce your CGT liability by planning ahead and using available tax reliefs and exemptions wisely. Strategic timing and understanding the rules are key to minimising the amount payable.

Tips to reduce CGT:

- Use your CGT allowance before the tax year ends

- Transfer property to your spouse to split the gain and double the allowance

- Time your sale to occur in a lower-income year to benefit from lower tax rates

- Offset capital losses from other investments against your property gain

- Claim all eligible deductions such as improvement costs, legal fees, and agent fees

Seeking advice from a qualified tax adviser can also help structure your affairs efficiently.

Conclusion

Knowing how to report and pay Capital Gains Tax on UK property is essential for property owners and investors. With the correct documentation, timely action, and understanding of allowances, you can remain compliant and avoid unnecessary penalties.

HMRC’s system is designed to streamline the process, but the responsibility lies with you to get it right. Whether you’re a resident or overseas landlord, understanding the rules ensures you manage your property gains efficiently and legally.

Frequently Asked Questions

Can I use my personal tax account to report Capital Gains Tax on property?

No, you must use the specific CGT on UK property account, not your general personal tax account.

Do I need to report the sale of my only home for CGT purposes?

Not if the sale qualifies fully under Private Residence Relief and there is no gain to report.

How does gifting a property affect Capital Gains Tax?

Gifting a property (except to a spouse or charity) counts as a disposal and may trigger CGT based on the property’s market value.

Are there different CGT rules for commercial properties?

Yes, commercial property gains are taxed at 10% or 20%, which are lower rates than those for residential property.

What if I make a loss on selling a UK property?

You can report the loss and use it to offset future gains, reducing your overall CGT liability.

How do non-residents report UK property sales for CGT?

Non-residents must report via the online CGT property account within 60 days, regardless of whether any tax is due.

Do I still need to report if there is no Capital Gains Tax to pay?

Yes, reporting is required even if no CGT is owed, especially for non-residents and certain exempt transactions.