Have you recently noticed a payment labelled “DWP SP” on your bank statement and found yourself puzzled by what it actually means?

If you’ve reached the UK’s state pension age or are caring for someone who has, you’re likely seeing a State Pension payment issued by the Department for Work and Pensions (DWP).

While it seems like a random set of letters, this code plays an important role in the financial lives of pensioners across the country.

This blog aims to clear up any confusion and walk you through what “DWP SP” truly signifies, what it includes, and how it may impact your finances.

What is DWP SP on Bank Statement?

The term “DWP SP” is a standard banking reference that stands for a State Pension payment from the Department for Work and Pensions.

If you’ve qualified for the UK State Pension by reaching the eligible age and having enough National Insurance contributions, this is how your pension will appear on your bank statement.

The Department for Work and Pensions (DWP) is the governmental body responsible for distributing a wide range of benefits, and SP specifically refers to the State Pension. When you see this entry, it indicates that your State Pension payment has been transferred into your account.

The amount may vary based on your individual entitlement, and it’s typically paid every four weeks. It’s crucial to remember that although “SP” most commonly means State Pension, DWP also uses various codes for other benefits.

If you’re unsure, it’s best to cross-reference the payment with your entitlement schedule or consult with DWP directly.

Why Are You Seeing “DWP SP” on Your Bank Transactions?

If you’re seeing “DWP SP” on your bank statement, it usually means the DWP has deposited a State Pension payment into your account. This is part of the UK’s welfare system, supporting individuals who’ve reached the qualifying pension age.

Here’s why you might see this:

- You’ve Reached State Pension Age: Once you turn the qualifying age, you’re eligible to start receiving your pension, provided you’ve met the National Insurance requirements.

- You’ve Successfully Applied: The payment reflects that your State Pension application has been approved.

- You’ve Deferred but Now Claimed: If you delayed claiming your pension, this could be the first of your resumed payments.

- It’s a Backdated Payment: You may be receiving a larger lump sum if there was a delay in processing your initial claims.

Additionally, DWP SP entries are always coded uniformly on your statement, making them easily identifiable.

However, if you’re unsure about a particular payment:

- Check Your DWP Letters: They often include specific payment dates and amounts.

- Call the Pension Service: For clarification on unexpected entries.

- Cross-verify with National Insurance contributions: This helps confirm entitlement and amounts.

Being aware of these possibilities ensures you know what the DWP SP deposit reflects.

Who Sends the DWP SP Payment, and What Does It Cover?

The Department for Work and Pensions (DWP) is responsible for issuing the DWP SP payment, which stands for State Pension. This is a government benefit meant for UK residents who have reached the State Pension age and have enough qualifying National Insurance contributions.

How Does the Department for Work and Pensions Process These Payments?

Once you apply or become eligible for State Pension:

- Your eligibility is assessed based on your National Insurance history.

- Your payment is scheduled every four weeks into your nominated bank account.

- You receive letters confirming the start date, amount, and any future payment changes.

- You’ll see “DWP SP” as a transaction reference on your bank statement.

DWP uses automated systems linked to your National Insurance number, ensuring payment accuracy and security. They also notify you of any adjustments through post or the official DWP online account. It’s essential to keep your banking details updated to avoid missed payments.

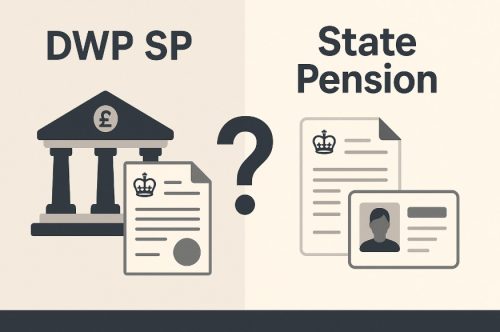

Is DWP SP the Same as State Pension or a Different Benefit?

Yes, DWP SP is the State Pension. It is not a separate or additional benefit. However, confusion often arises because DWP administers multiple benefits, such as Pension Credit (PC), Attendance Allowance, and Carer’s Allowance.

The SP specifically refers to the State Pension, and you’ll only see this if:

- You’ve reached pension age

- You’ve applied (or your entitlement has been processed)

- Payments are actively being disbursed into your account

Unlike other codes like DWP PC (Pension Credit), which supports low-income pensioners, DWP SP is based purely on your National Insurance contributions. It’s a retirement income, not means-tested, and is structured to support you in later life.

When Are DWP SP Payments Typically Deposited into Bank Accounts?

DWP SP payments are usually paid every four weeks, not monthly. The payment day is determined by the last two digits of your National Insurance number, which helps the DWP manage distribution efficiently.

For instance:

- NI numbers ending in 00–19: Paid on Monday

- 20–39: Paid on Tuesday

- 40–59: Paid on Wednesday

- 60–79: Paid on Thursday

- 80–99: Paid on Friday

If a scheduled payment date falls on a bank holiday, your payment will usually arrive on the working day before.

Payments are made directly into the account details you provided when applying for the State Pension. Be sure to keep your bank details current to prevent issues.

Can You Receive DWP SP Without Applying for It?

Generally, you must apply for your State Pension to start receiving DWP SP payments. The DWP will not automatically begin payments when you reach the qualifying age.

However, they will send a State Pension invitation pack about four months before you reach State Pension age, encouraging you to apply.

What Conditions Qualify Someone for Automatic Payments?

Though most pensioners must apply, some cases may qualify for prompt or seemingly automatic payments:

- Timely response to DWP letters

- Accurate and up-to-date National Insurance records

- Early online application via the government portal

- Receiving certain benefits already linked to DWP records

- Reinstatement of deferred pensions

In rare cases, if you’ve previously deferred and resumed claiming, payments may begin without reapplying, but these are exceptions. Always verify payment schedules and entitlements with DWP to ensure you’re receiving what you’re owed.

What Should You Do If You Receive a DWP SP Payment Unexpectedly?

An unanticipated DWP SP payment can understandably cause concern. It’s essential to stay calm and investigate the source before taking any action.

Here’s what you should do:

- Review Your Correspondence: Check any recent DWP letters for explanations.

- Look for Backdated Claims: If you recently applied, this could be an approved claim with arrears.

- Check Family Circumstances: If you’re a carer or executor, this could be related to a relative’s entitlements.

- Verify Bank Details and NI Number: Ensure the account and reference match your information.

If the payment still appears incorrect:

- Contact DWP immediately: Call the Pension Service for clarification.

- Avoid spending the funds: Until confirmed, don’t assume it’s yours to keep.

- Inform your bank: In case of a suspected error, they may help flag it with DWP.

Quick action ensures you’re protected from repayment demands or confusion.

Is DWP SP Payment Taxable or Will It Affect Other Benefits?

The State Pension (DWP SP) is considered taxable income, although tax is not directly deducted from the payment.If your total annual income exceeds your personal allowance, you may need to pay tax through other means, such as deductions from workplace or private pensions.

It may also affect other income-related benefits:

- Pension Credit: Might be reduced if State Pension exceeds the minimum income threshold.

- Housing Benefit and Council Tax Reduction: Can also be impacted depending on total household income.

- Universal Credit: Pension income is taken into account if you live with a working-age partner.

It’s wise to report any income changes to avoid overpayments or benefit reductions.

Conclusion

Seeing DWP SP on your bank statement is usually a positive sign that your State Pension has been successfully processed and paid. Understanding these payment codes helps eliminate confusion and ensures you stay in control of your finances.

Whether you’re newly retired or just keeping an eye on your loved ones’ statements, it’s always helpful to know where the money is coming from and why. If anything seems unclear or unexpected, don’t hesitate to reach out to DWP or your bank for peace of mind.

FAQs About DWP SP on Bank Statement

What is the difference between DWP SP and DWP PC?

DWP SP refers to State Pension, which is based on National Insurance contributions, while DWP PC stands for Pension Credit, a means-tested top-up for low-income pensioners.

Can I opt out of receiving State Pension if I’m still working?

Yes, you can defer claiming your State Pension to increase its value later, even if you are still employed.

How does DWP decide your pension payment schedule?

Your payment day is based on the last two digits of your National Insurance number, allowing DWP to distribute payments evenly throughout the week.

Are DWP SP payments ever backdated?

Yes, if your claim is processed late or you deferred your pension, payments may be backdated to cover the missed period.

What should I do if the payment amount seems wrong?

Contact DWP or the Pension Service to report the issue and verify if the amount matches your entitlement.

Can I receive DWP SP while living abroad?

Yes, UK State Pension can be paid if you live abroad, but some increases may not apply depending on the country.

Is it safe to share my DWP letters with banks or financial advisors?

Yes, but ensure you share only with trusted institutions and avoid including full personal identifiers unless absolutely necessary.