Losing a loved one is never easy, and alongside the emotional toll comes the practical challenge of sorting out finances. One of the most common questions many widows ask is: If my husband dies do I get his State Pension?

The answer isn’t entirely straightforward, it depends on a variety of factors, such as when your husband reached State Pension age, whether he had additional pension components, and if he had deferred claiming it. This guide will walk you through everything you need to know about inheriting your husband’s State Pension in the UK.

How Does State Pension Inheritance Work in the UK?

In the UK, inheriting your husband’s State Pension depends mainly on when he reached State Pension age and whether you were legally married or in a civil partnership at the time of his death. There are two pension systems to consider: the old State Pension (before 6 April 2016) and the new State Pension (after 6 April 2016).

Under the old State Pension system, you may be able to inherit part of your husband’s Additional State Pension or Graduated Retirement Benefit. If you do not receive the full basic State Pension, your husband’s NI record may help increase your entitlement.

Under the new State Pension system, inheritance is limited but still possible. You may inherit protected payments or additional State Pension, depending on his NI contributions and whether he deferred his pension.

To check what you’re entitled to, you must:

- Contact the Pension Service.

- Provide personal details including your husband’s NI number and your date of birth.

- Review your own State Pension entitlement for any adjustments based on his record.

It’s important to note that you must not have remarried before reaching your own State Pension age to qualify.

Can You Inherit Your Husband’s Basic State Pension?

Inheriting your husband’s basic State Pension is only possible under the old pension rules, which apply if he reached or would have reached State Pension age before 6 April 2016.

If you don’t qualify for the full basic State Pension based on your own National Insurance (NI) contributions, you may be able to use his record to boost your pension.

Women who reached State Pension age before 6 April 2016 can receive up to 100% of the basic State Pension based on their husband’s NI record.

Additionally, if you’re a woman married to a man or someone who transitioned to female during marriage, and your spouse was born before 6 April 1950, you might benefit from the old pension top-up scheme.

In most cases, this increase is automatic when claiming your pension. However, if your husband claimed before 2008, contact the Pension Service directly

What Are the Rules Under the New State Pension System?

If your husband reached State Pension age on or after 6 April 2016, the new State Pension rules apply. These rules are stricter when it comes to inheritance.

Generally, State Pension under this system is based solely on your own NI contributions. However, there are still certain instances where inheritance is possible.

Under the new system:

- You might inherit up to 50 percent of a protected payment your husband had, but only if you were married before 6 April 2016 and remained so until his death.

- You cannot inherit any of your husband’s State Pension if you remarry or form a civil partnership before reaching your own State Pension age.

- Deferred pensions built under this system do not create an inheritance entitlement.

To check your eligibility:

- Use the State Pension and Your Partner tool on GOV.UK.

- Contact the Pension Service or the International Pension Centre if you live abroad.

Understanding these differences between old and new systems is vital when planning or applying for entitlements.

Are You Entitled to Your Husband’s Additional State Pension or Protected Payments?

The Additional State Pension and Protected Payments offer potential support, especially under the old pension system. These include entitlements from:

- State Second Pension (S2P)

- State Earnings-Related Pension Scheme (SERPS)

- Graduated Retirement Benefit (GRB)

If your husband built up Additional State Pension before 6 April 2016, you could inherit a portion depending on:

- Your own State Pension age

- The number of qualifying years he had on his NI record

- Whether he had any protected payments from the transition to the new system

You may inherit:

- 50% of his protected payment (only under specific eligibility criteria)

- All or part of his Additional State Pension, if you meet the required conditions

It’s essential to check with the Pension Service to understand what specific parts apply to you. These payments could make a significant difference to your retirement income.

What Is the Bereavement Support Payment and Are You Eligible?

Apart from State Pension entitlements, you may also be able to claim Bereavement Support Payment (BSP) if your husband passed away within the last 21 months.

This benefit is designed to provide short-term financial help to those who have lost a spouse or civil partner.

To Qualify

- You must have been under State Pension age when he died.

- Your husband must have paid sufficient NI contributions.

- You must have been living in the UK or a country where the UK has a social security agreement.

What You May Receive?

- An initial lump sum of £2,500 (or £3,500 if you have children)

- Up to 18 monthly payments of £100 (or £350 with children)

How to Claim?

- Apply online at GOV.UK

- Call the Bereavement Service helpline

- Submit your application within 21 months of his death

This payment is not means-tested and tax-free. While it’s separate from the State Pension, it can be an important financial lifeline during a difficult time.

Do Civil Partners and Same-Sex Spouses Have the Same Pension Rights?

Yes, civil partners and same-sex spouses have equal pension rights under UK law, provided they meet the same eligibility criteria as heterosexual couples. Whether you’re in a civil partnership or same-sex marriage, you may inherit a part of your partner’s State Pension under either pension system.

However, there are a few key things to remember:

- Your partnership must have been registered before 6 April 2016 to inherit protected payments under the new system.

- You must have remained in the partnership until your partner’s death.

- You must not remarry or form a new civil partnership before reaching State Pension age to retain entitlement.

The same rules apply when claiming Bereavement Support Payment, Additional State Pension, and benefits from deferred pensions.

These rights represent a significant step forward in equality, but it’s still essential to contact the Pension Service to confirm your exact entitlement based on individual circumstances.

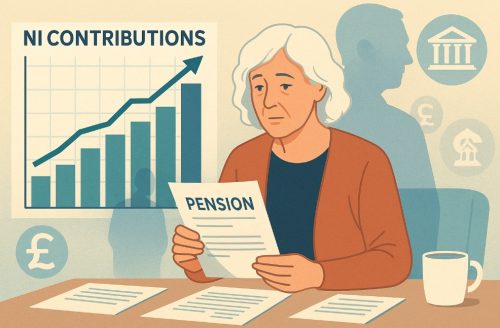

Can You Use Your Husband’s National Insurance Contributions to Boost Your Pension?

In certain cases, your husband’s National Insurance contributions can be used to increase your own State Pension. This is more likely under the old State Pension system (pre-April 2016), especially if you don’t already receive the full basic State Pension.

Here’s what you should know:

- If your husband had enough qualifying years, you might be able to top up your pension to the full basic rate.

- For the 2025–26 tax year, the full basic State Pension is £176.45 per week.

- You won’t be eligible to use his NI contributions if you remarry or enter into a new civil partnership before reaching State Pension age.

The increase often happens automatically, but if it doesn’t, you should:

- Contact the Pension Service or Northern Ireland Pension Centre.

- Provide both NI records and proof of marital status.

This method of boosting your pension could significantly increase your retirement income and financial independence.

What Are the Tax and DWP Guidelines for Widows?

Understanding the tax rules and Department for Work and Pensions (DWP) guidelines is crucial for widows navigating State Pension entitlements. Here’s what you need to consider:

- Most inherited State Pension elements, like Additional State Pension, are taxable if your total income exceeds the personal allowance.

- The basic State Pension itself is taxable, though tax is not deducted at source. HMRC adjusts your tax code accordingly.

- Payments from private or occupational pensions may already be taxed before you receive them, depending on the scheme.

DWP guidelines include:

- You should report the death of your husband as soon as possible via the Tell Us Once service.

- Contact the Pension Service to claim any inherited pension or extra payments.

- Be prepared to submit official documents, such as death certificates and NI numbers.

Failing to follow these steps promptly could delay your benefits. It’s advisable to speak with a pension advisor or use official online tools provided by the government for further clarification.

What Pension Benefits Could You Be Entitled to?

Understanding what pension benefits you may be entitled to after your husband’s death can help ease financial uncertainty. Here’s a simple table overview of the main types of pension benefits and their eligibility criteria.

| Type of Pension Benefit | Eligibility Criteria | Possible Inheritance |

| Basic State Pension | Reached SP age before 6 April 2016 and do not get full pension | Top-up using husband’s NI record |

| Additional State Pension (SERPS, S2P) | Partner built up pension before 6 April 2016 | Partial or full inheritance possible |

| Protected Payment | Married before 6 April 2016, partner reached SP age after | Inherit up to 50% |

| Bereavement Support Payment | Under State Pension age at time of death | Lump sum and monthly payments |

| Deferred Pension | Partner deferred claiming pension | Lump sum or increased payments |

| Private/Workplace Pension | Dependent on scheme rules | Check with pension provider |

Always review your personal circumstances and contact the relevant pension service or provider to ensure you’re claiming all the benefits you’re entitled to.

What Key Points Should You Remember About Inheriting a State Pension?

When considering your entitlement to your late husband’s State Pension, keep these key points in mind:

- Check the date he reached or would have reached the State Pension age to know which system applies.

- Confirm whether you reached the State Pension age before or after 6 April 2016.

- Consider whether your husband deferred his pension, as this could entitle you to more.

- Avoid remarrying before reaching the State Pension age, or you may lose your inheritance rights.

- Always contact the Pension Service to confirm your entitlements.

- Ensure all documents are prepared, including NI records, marriage certificate, and death certificate.

Understanding these essentials ensures you don’t miss out on important financial support you may be entitled to.

How Can You Prepare for State Pension Transfer After a Spouse’s Death?

Planning ahead can ease the process of pension inheritance and protect your financial future. Consider taking these steps:

- Review your own State Pension record to determine any gaps in NI contributions.

- Speak with a financial or pension advisor who specialises in bereavement and retirement planning.

- Prepare a folder of essential documents, such as marriage certificates, NI numbers, and pension scheme contacts.

- If your husband is still alive, consider whether deferring his pension could benefit you.

- Use tools like the State Pension forecast calculator on GOV.UK to estimate your future payments.

- Understand the full range of death benefits across both public and private pensions.

Proactive preparation ensures that when the time comes, you and your family are financially protected.

Conclusion

Losing a husband is deeply painful, and navigating State Pension rules can add stress. However, understanding your entitlements, whether through the basic or additional State Pension, protected payments, or Bereavement Support Payment, can ease financial burdens.

The UK system offers inheritance rights for spouses meeting specific criteria. Knowing your husband’s pension age, National Insurance record, and your own status is key.

Check your entitlements, contact relevant government services, and seek advice if needed to secure your financial future during this challenging time.

FAQs About Inheriting State Pension After Spouse’s Death

Can I claim both my own and my husband’s State Pension?

No. You’ll usually get your own State Pension. However, you may inherit a portion of your husband’s Additional Pension or protected payment.

How long can I receive Bereavement Support Payments?

Up to 18 months from the date of your husband’s death. Apply within 3 months to get the full amount.

Do second marriages affect inherited State Pension rights?

Yes. If you remarry or enter a civil partnership before reaching your own State Pension age, you may lose your right to inherit.

What happens if my husband had not reached State Pension age before passing?

You may still receive benefits based on his NI contributions, but inheritance options vary under different pension rules.

Is inherited pension considered taxable income?

Yes. In most cases, pension payments, including inherited amounts, are subject to income tax.

Can I inherit if we were separated but still married?

Yes. Being separated does not typically affect your eligibility, as long as you were legally married at the time of death.

What do I do if I believe I’ve missed a pension payment?

Contact the Pension Service as soon as possible to investigate any missed or delayed payments.