Choosing the right credit card in 2025 can be overwhelming with so many options available.

Whether you are looking for cashback rewards, travel benefits, or low-interest rates, finding the perfect card requires careful consideration.

FintechZoom provides expert insights to help users make informed decisions about the best credit cards.

By understanding the various features, fees, and benefits, you can select a card that aligns with your financial goals.

In this guide, we explore the FintechZoom best credit card, the factors to consider, and how to choose the right one for your needs.

Keep reading to discover the top-rated cards and essential tips to make the most of your credit card in 2025.

What Makes a Credit Card the Best Choice in 2025?

As financial needs evolve, the best credit cards in 2025 offer flexibility, rewards, and enhanced security.

With digital transactions becoming the norm, choosing a card that aligns with your lifestyle is essential.

Here are the key features that define a top-tier credit card in 2025:

- Competitive Interest Rates: A lower Annual Percentage Rate (APR) helps manage outstanding balances effectively. Many cards now offer a 0% introductory APR for a specific period, reducing interest costs.

- Rewards and Cashback: Premium cards provide cashback, travel rewards, or loyalty points based on spending categories. Additional perks like free airport lounge access and insurance coverage enhance value.

- Low Fees: No annual or foreign transaction fees make a credit card cost-effective. Avoiding hidden charges ensures better financial planning.

- Security and Fraud Protection: Modern security features like biometric authentication and real-time fraud alerts offer enhanced protection. Zero-liability policies ensure you aren’t responsible for unauthorised transactions.

- Customised Credit Limits: Some credit cards provide adjustable limits based on income and spending patterns.

By choosing a credit card that suits your financial habits, you can maximise benefits while minimising expenses.

How Do Different Types of Credit Cards Work?

Credit cards are designed to cater to different financial needs, and choosing the right type ensures maximum benefits.

Each card offers specific rewards, fees, and interest rates based on its purpose.

Cashback Credit Cards

- These cards offer a percentage of your spending back in the form of cashback.

- They are ideal for everyday expenses like fuel, dining, and groceries, helping users save on frequent purchases.

Travel Credit Cards

- Designed for frequent travellers, these cards offer airline miles, hotel discounts, and travel insurance.

- Many also provide complimentary lounge access and discounts on international transactions.

Business Credit Cards

- Aimed at professionals and entrepreneurs, these cards help manage business expenses efficiently.

- They offer high credit limits and rewards on business-related purchases like office supplies and travel.

Student Credit Cards

- Tailored for students, these cards come with low credit limits and fewer fees.

- They are an excellent option for building a credit history while learning financial responsibility.

Low-Interest Credit Cards

- Best suited for individuals who carry a balance, these cards have lower APRs.

- They make repayments more affordable and help avoid high interest on outstanding amounts.

Understanding the different credit card types ensures you select one that aligns with your spending habits and financial goals.

How Can You Choose the Perfect Credit Card for Your Needs?

Selecting a credit card that matches your financial requirements is crucial for maximising benefits while avoiding unnecessary costs.

Consider the following factors before applying:

Analyse Your Spending Habits

- Frequent travellers should opt for travel credit cards with rewards on airfare and hotels.

- If most expenses are on shopping or fuel, cashback credit cards provide better savings.

Compare Interest Rates and Fees

- A low APR is beneficial if you tend to carry a balance on your card.

- Look for cards with no annual or foreign transaction fees to minimise costs.

Consider Reward Programs

- Some cards offer category-specific rewards like dining, groceries, or fuel.

- Check reward expiration policies to ensure you maximise benefits.

Review Security and Benefits

- Choose a card with fraud protection, purchase insurance, and digital payment integration.

Check Credit Score Requirements

- Premium cards require excellent credit scores, whereas student and secured cards are more accessible.

By evaluating these aspects, you can find a credit card that best fits your financial lifestyle.

Are Cashback Credit Cards Better Than Travel Credit Cards?

Choosing between cashback and travel credit cards depends on your spending habits and lifestyle. Both offer unique benefits, but they cater to different financial priorities.

Cashback credit cards provide an instant percentage of money back on purchases. They are ideal for individuals who frequently spend on groceries, utilities, and everyday expenses.

Cashback is straightforward to redeem, making it a hassle-free way to save money on regular purchases.

In contrast, travel credit cards are best suited for frequent travellers. They offer rewards like airline miles, hotel discounts, and travel insurance.

These cards can significantly reduce travel expenses, but rewards typically take longer to accumulate and redeem.

If your primary goal is saving on everyday spending, a cashback card is the better option.

However, if you frequently travel, a travel rewards card provides more value through exclusive travel benefits. Understanding your spending habits helps in choosing the right card.

Can a Credit Card Help Improve Your Credit Score?

Yes, using a credit card responsibly is one of the most effective ways to improve your credit score.

Credit cards influence multiple factors in your credit report, including payment history and credit utilisation.

Making timely payments every month is the most crucial aspect of maintaining a good credit score. Late or missed payments can negatively impact your credit history and make it harder to qualify for loans.

Additionally, keeping your credit utilisation low, by using less than 30% of your credit limit, shows lenders that you manage credit responsibly.

Regular use of your credit card, followed by full repayments, builds a strong credit profile.

Over time, responsible usage can lead to a higher credit score, helping you qualify for better financial products. On the other hand, maxing out your credit card or missing payments can harm your creditworthiness.

By managing your credit card wisely, you can steadily improve your credit score and enhance financial stability.

What Are the Common Fees Associated with Credit Cards?

Understanding credit card fees helps users avoid unnecessary costs and choose cost-effective options.

Here are the most common fees associated with credit cards:

Annual Fees

- Some premium cards charge an annual fee in exchange for exclusive rewards.

- Many basic credit cards offer no annual fees, making them a budget-friendly option.

Interest Charges

- If you carry a balance, interest is applied, often at a high APR.

- Low-interest credit cards help reduce long-term interest costs.

Foreign Transaction Fees

- Some cards charge extra fees for international purchases.

- Travel credit cards typically waive these fees for frequent travellers.

Late Payment Penalties

- Missing a due date results in penalties and negatively impacts your credit score.

- Setting up automatic payments can help avoid these charges.

Cash Advance Fees

- Withdrawing cash from a credit card attracts high interest and fees.

- It’s advisable to use a debit card for cash withdrawals instead.

By understanding and comparing these fees, you can choose a card that offers the best value while keeping costs low.

Top 8 Fintechzoom Best Credit Cards for 2025

1. Chase Freedom Unlimited

The Chase Freedom Unlimited is a highly recommended card for those who want to earn cash back without complicating their rewards structure.

It offers impressive returns on a variety of spending categories, making it ideal for everyday purchases.

- 5% cash back on travel purchased through Chase Travel

- 3% cash back on dining and drugstore purchases

- 5% cash back on all other purchases

- No expiration on rewards as long as the account remains open

- $0 annual fee

- Introductory 0% APR for 15 months on purchases and balance transfers, then variable APR of 20.49% – 29.24%

This card’s flexible cash-back rewards and no annual fee make it a top contender for those who want to earn rewards on all kinds of everyday purchases.

The lack of minimum redemption requirements makes it even more convenient for cardholders to redeem rewards at any time.

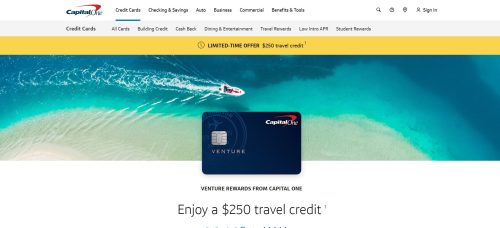

2. Capital One Venture Rewards Credit Card

For those who travel frequently, the Capital One Venture Rewards Credit Card is an excellent option with generous travel rewards and a significant sign-up bonus.

- 2 miles per dollar on every purchase

- 5 miles per dollar on hotels and rental cars booked through Capital One Travel

- 75,000-mile sign-up bonus after spending $4,000 in the first 3 months, equivalent to $750 in travel

- No foreign transaction fees

- TSA PreCheck benefits to expedite airport security

- $95 annual fee

This card is perfect for travelers who want simplicity and flexibility with their rewards. The 75,000-mile bonus is an enticing feature, covering a significant portion of the annual fee.

Miles can be redeemed for travel expenses, and the card’s rewards structure is ideal for frequent travelers looking to accumulate points quickly.

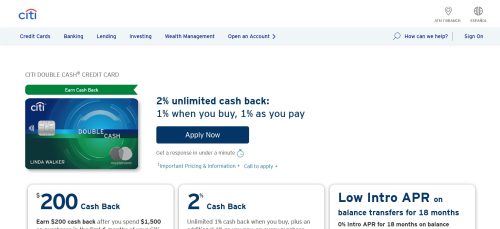

3. Citi Double Cash Card

The Citi Double Cash Card is a straightforward and high-earning credit card that’s perfect for those who want an easy-to-manage cash-back program.

- 1% cash back on every purchase

- 1% cash back when you pay your bill.

- This gives you 2% total cash back on all purchases, making it a fantastic option for those who want to earn rewards without worrying about rotating categories or caps.

- $0 annual fee

- No limit on cash back earned

- Thank You points can be redeemed for cash back, gift cards, or travel

- This card is perfect for those who appreciate simplicity.

With no rotating categories or limits on cash back, you can earn 2% on every dollar you spend, which adds up quickly over time.

4. Discover it Cash Back

The Discover it Cash Back card offers a unique rotating category program, which allows you to earn 5% cash back on select categories each quarter.

- 5% cash back on up to $1,500 in rotating categories each quarter (after activation)

- 1% cash back on all other purchases

- Cashback Match program doubles all the cash back you’ve earned at the end of your first year

- $0 annual fee

- 0% intro APR for 15 months on purchases

This card’s rotating categories offer ample opportunities to maximize your cash back throughout the year, and the Cashback Match program makes it one of the best options for new cardholders, essentially doubling your rewards during the first year.

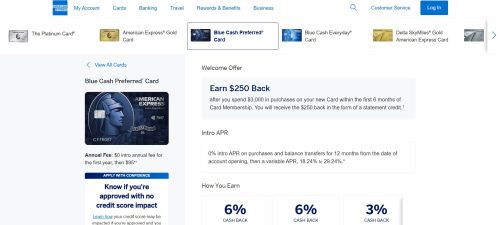

5. Blue Cash Preferred Card from American Express

The Blue Cash Preferred® Card from American Express is ideal for families and individuals who spend a lot on groceries and commuting. It offers one of the highest cash back rates in these categories.

- 6% cash back at U.S. supermarkets (on up to $6,000 per year, then 1%)

- 6% cash back on select U.S. streaming subscriptions

- 3% cash back at U.S. gas stations and on transit, including taxis, rideshares, parking, tolls, trains, and buses

- 1% cash back on all other purchases

- $0 introductory annual fee for the first year, then $95 annually

This card’s substantial cash-back rates on supermarket and transit spending make it an ideal choice for those looking to earn rewards on essential, everyday purchases.

The high earning rate on streaming subscriptions also adds extra value, especially for families who subscribe to multiple services.

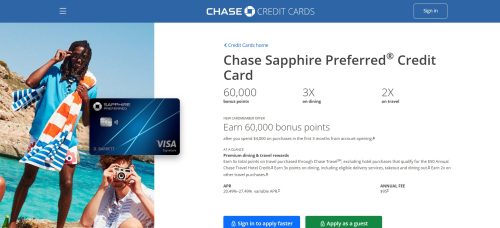

6. Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is a premium travel rewards card with one of the most competitive point-earning structures in the industry.

- 5X points on travel purchased through Chase Travel

- 3X points on dining

- 2X points on all other travel purchases

- 60,000 bonus points after spending $4,000 in the first 3 months

- No foreign transaction fees

- $95 annual fee

This card provides exceptional value for travelers, with the bonus points translating into significant travel savings.

Additionally, points earned are worth 25% more when redeemed for travel through Chase Ultimate Rewards, making it a highly valuable card for frequent travelers.

7. Wells Fargo Active Cash Card

The Wells Fargo Active Cash Card is perfect for individuals who want a simple and easy-to-understand cash-back card that provides excellent rewards on all purchases.

- 2% cash back on every purchase

- $200 cash rewards bonus after spending $500 in the first 3 months

- $0 annual fee

- 0% intro APR for 15 months on purchases

- No foreign transaction fees

This card offers hassle-free rewards with unlimited 2% cash back on all purchases, making it ideal for people who want to earn cash back without tracking spending categories.

It also provides a generous sign-up bonus and no annual fee, making it a great all-around card for everyday spending.

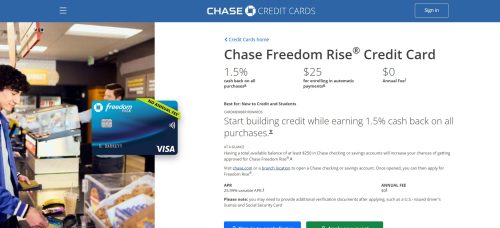

8. Chase Freedom Rise

Chase Freedom Rise is a great option for beginners looking to build their credit while earning cash back.

It’s designed to offer an easy entry into the world of credit cards with valuable rewards.

- 1.5% cash back on every purchase

- $0 annual fee

- $25 statement credit for setting up automatic payments within the first 3 months

- No credit history required

- Potential credit line increase after 6 months of responsible usage

This card is ideal for those new to credit or looking to rebuild. It offers simple rewards and an easy path to increasing your credit line, making it a great starter card for credit building.

Each of these top 8 credit cards stands out in its category, offering rewarding features, flexibility, and valuable perks for all kinds of cardholders, from frequent travelers to those looking to build or rebuild their credit.

Conclusion

Selecting the right credit card depends on your lifestyle and financial goals. Whether you prioritise cashback, travel rewards, or low interest rates, there are numerous options available to suit different needs.

By understanding the various card types, fees, and benefits, you can make an informed decision that maximises value while minimising costs.

With FintechZoom’s expert insights, you can confidently choose a card that aligns with your financial strategy.

Make sure to compare offers, read terms carefully, and use your card responsibly to enjoy its full advantages.

FAQs About Fintechzoom Best Credit Card

What is the best way to maximise credit card rewards?

Use your card for everyday purchases in high-reward categories and pay off the balance monthly. Choose a card with rewards that match your spending habits.

Can you switch credit cards without affecting your credit score?

Yes, but frequent applications can cause temporary dips in your score. Balance transfers and maintaining old accounts help stabilise your credit rating.

Are premium credit cards worth the annual fee?

They are beneficial if the perks, like travel rewards and cashback, outweigh the fee. Frequent travellers and high spenders benefit the most.

What is the safest way to use a credit card online?

Shop only on secure websites, enable two-factor authentication, and monitor transactions. Using virtual cards or digital wallets adds extra protection.

How does a 0% interest credit card work?

It offers an interest-free period on purchases or balance transfers for a set time. Payments must be made on time to avoid high post-introductory interest rates.

Can you get a credit card with a bad credit score?

Yes, secured and subprime credit cards help build or rebuild credit. Responsible use and timely payments improve credit over time.

How do business credit cards differ from personal credit cards?

Business cards offer rewards on office expenses and higher credit limits. They help separate personal and business finances for better expense management.