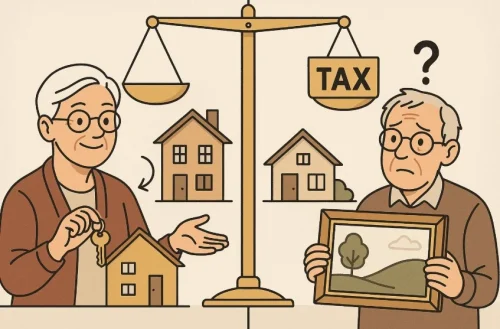

Inheritance Tax (IHT) is often described as the “voluntary tax”, a charge that can largely be avoided with careful planning. Yet, every year, countless families find themselves unexpectedly liable for thousands of pounds because of one complex rule: the gift with reservation of benefit.

It sounds harmless, after all, it’s just a gift. But when that gift isn’t structured correctly, it can undo years of estate planning and leave your loved ones with an unexpected tax bill.

This article will explain what a gift with reservation of benefit (GROB) is, how it affects inheritance tax, and how you can plan effectively to avoid falling into this costly trap.

What Is a Gift with Reservation of Benefit and Why Should You Care?

A gift with reservation of benefit occurs when you give away an asset, such as your home, shares, or valuable possessions, but continue to benefit from it after the transfer.

In simple terms, if you still live in, use, or profit from an asset you’ve given away, HMRC treats it as though you never gave it away at all. As a result, for inheritance tax purposes, that asset remains part of your estate upon your death.

The concept was introduced as an anti-avoidance measure to prevent individuals from reducing their taxable estate on paper while retaining practical control over their assets.

Example:

A parent transfers ownership of their family home to their children but continues living in it rent-free. Even though the legal title has changed, the parent still enjoys the benefit of living there. HMRC therefore considers it a gift with reservation, and the property will remain in the parent’s estate for IHT purposes.

If you’re not aware of these rules, or assume a simple transfer of ownership protects your estate, you may unintentionally create a tax liability for your beneficiaries.

How Does HMRC Treat Gifts with Reservation of Benefit for Inheritance Tax?

Under normal circumstances, when you make a lifetime gift, it is classified as a Potentially Exempt Transfer (PET). If you survive for seven years after making that gift, it falls outside your estate and becomes exempt from inheritance tax. However, a gift with reservation of benefit does not qualify as a PET.

HMRC’s stance is clear: if you continue to derive benefit from a gifted asset, the seven-year rule does not apply. Instead, the asset remains part of your taxable estate at its market value at the date of your death.

This rule applies regardless of how long ago the gift was made, five years, ten years, or even thirty years earlier. Unless you completely give up the benefit, the property is never excluded from your estate.

PET vs GROB – Key Differences:

| Feature | Potentially Exempt Transfer (PET) | Gift with Reservation of Benefit (GROB) |

| Donor continues to benefit? | No | Yes |

| 7-year rule applies? | Yes | No |

| Asset excluded from estate after 7 years? | Yes | No |

| Inheritance tax payable? | Only if donor dies within 7 years | Always included in estate |

| Typical example | Gifting cash or property and ceasing all use | Gifting property but continuing to live in it rent-free |

This distinction forms the backbone of HMRC’s approach to preventing estate undervaluation. Understanding it is crucial before making any significant lifetime transfers.

Can You Gift Property but Still Live in It Without Paying Tax?

One of the most common Gift with Reservation of Benefit (GROB) scenarios occurs when a homeowner transfers their main residence to their children but continues living there. If you gift your home yet still occupy it without paying full market rent, HMRC considers it a GROB.

To avoid this, you must either pay rent at market value or completely give up your right to live in the property.

You can legally remain in a home you’ve gifted if you pay your children a full commercial rent, formalised through a tenancy agreement and reviewed regularly. However, there’s a catch, the rent your children receive becomes taxable income, creating a new tax liability.

Real-Life Example:

Consider Mary, who gifts her £600,000 home to her son David but continues living there. Mary pays David £1,200 per month in rent, reflecting the property’s market rate. This rent is declared as income on David’s tax return, and the GROB rule does not apply.

However, if Mary had lived there rent-free, or at a reduced rate, the house would have remained in her estate for inheritance tax purposes.

What Assets Commonly Trigger GROB Rules?

While property is the most frequent culprit, the GROB rules apply to any asset that confers ongoing benefit to the donor.

Typical Scenarios:

- Family homes: A parent gifts their residence to children but continues to occupy it.

- Holiday properties: Even occasional personal use after gifting can trigger a GROB.

- Valuable items: Artwork, jewellery, antiques, or cars gifted but retained for personal enjoyment.

- Business shares: Gifting shares but retaining voting control or dividend rights.

Common GROB Triggers and How to Avoid Them:

| Asset Type | GROB Trigger | Possible Solution |

| Main home | Living there rent-free | Pay market rent or move out |

| Holiday home | Continued occasional use | Cease personal use entirely |

| Artwork or valuables | Keeping items in home | Transfer possession to recipient |

| Business shares | Retaining control rights | Fully transfer voting and dividend rights |

The essence of these examples is simple: you cannot both give and keep. If any personal benefit remains, HMRC considers the asset part of your estate.

When Is a Gift with Reservation NOT Considered a Tax Trap?

There are specific exceptions under UK law where a transfer will not be treated as a gift with reservation of benefit. These exemptions are crucial for legitimate estate planning.

Gifts to a Spouse, Civil Partner, or Charity

Transfers made to your spouse or civil partner are automatically exempt from inheritance tax, regardless of continued benefit. Similarly, gifts made to registered charities are exempt, even if the donor remains associated with the organisation.

Unforeseen Infirmity and Caregiving Exceptions

If you transfer your home but later move back due to old age or ill health, and the move was not prearranged, it won’t be considered a GROB. HMRC recognises this as a compassionate exception where the benefit was unforeseeable at the time of transfer.

Insignificant or Incidental Benefits

Certain minor or infrequent benefits, such as staying in a gifted property for a few days per year, do not constitute a GROB. The benefit must be substantial and continuous to trigger inclusion in your estate.

What Is the Pre-Owned Assets Tax and How Does It Relate to GROB?

The Pre-Owned Assets Tax (POAT) was introduced to close remaining loopholes in inheritance tax avoidance. It applies when an individual gives away an asset (or the money to buy it) and continues to benefit from it, but the GROB rules do not apply.

In such cases, instead of treating the asset as part of the estate, HMRC imposes an annual income tax charge on the benefit derived.

For instance, if you give your home to your children and continue to live there, but somehow avoid GROB classification, HMRC may still levy an annual POAT charge equivalent to the market rent of the property.

Comparison of GROB vs POAT:

| Feature | GROB | POAT |

| Purpose | Estate tax inclusion | Annual income tax on benefit |

| Applies when | Donor retains benefit | Donor benefits but GROB not triggered |

| Tax impact | Asset included in estate | Annual tax charge based on value |

| Avoidance | Give up benefit entirely | Elect for POAT charge in some cases |

In most instances, POAT ensures no one can sidestep inheritance tax by exploiting technicalities around benefit reservation.

How Can You Avoid the GROB Trap Legally and Effectively?

Avoiding the GROB trap requires foresight and proper documentation. The key principle is ensuring that no ongoing benefit is retained after the gift is made.

Pay Market Rent

If you wish to continue using the asset, particularly your home, paying full market rent is the most straightforward solution. The rent should be reviewed periodically and formalised with a written agreement.

Share Occupation

If you gift part of your home and continue living there jointly with the new owner, it may not be treated as a GROB. However, this only applies if each party pays their fair share of costs such as utilities, council tax, and maintenance.

Give Up the Benefit Completely

Alternatively, you can give up all benefit and allow the recipient full use of the asset. Once you have done so, the seven-year rule begins, and the gift will become exempt if you survive for that period.

Remember: these strategies must be executed correctly and supported by clear evidence to withstand HMRC scrutiny.

How Do GROB Rules Impact Your Estate Planning Strategy?

GROB rules have far-reaching implications for estate planning. Many well-meaning individuals make gifts assuming they are reducing their estate’s taxable value, only for HMRC to later reclaim the benefit.

The increasing value of property and the frozen IHT nil-rate band of £325,000 mean that more estates are now drawn into the inheritance tax net. The result is a growing number of HMRC investigations into improperly executed lifetime gifts.

For families, this can mean unexpected tax bills, legal disputes, and emotional stress during an already difficult time. Therefore, consulting an experienced estate planning adviser is not just advisable, it’s essential.

Is There a Difference Between Intentional and Accidental GROBs?

A particularly harsh aspect of GROB legislation is that intentions don’t matter. Even if the retention of benefit was accidental or unplanned, the gift may still be treated as reserved.

For example, if you gift your home but forget to update occupancy terms or fail to pay rent at the market rate, HMRC will still classify it as a GROB. The law focuses on the factual benefit received, not your motive.

However, where there is genuine ambiguity or dispute, HMRC may investigate, considering the timing, documentation, and financial evidence surrounding the gift. Maintaining clear agreements and records can protect your estate from costly reclassifications later.

Conclusion

A gift with reservation of benefit might appear to be an innocent or generous gesture, but its tax implications can be significant. The underlying principle is simple, if you continue to benefit from an asset you’ve given away, it remains part of your estate for inheritance tax purposes.

Understanding the distinction between legitimate gifts and reserved benefits is vital to avoid unintentional tax traps. Whether it’s your home, investments, or other valuable assets, careful structuring, professional advice, and documented arrangements are key to ensuring your generosity doesn’t backfire.

For readers planning lifetime gifts, this isn’t just about reducing tax, it’s about protecting your family’s financial future and ensuring your legacy passes as you intend.

Frequently Asked Questions

What happens if HMRC challenges a lifetime gift after death?

If HMRC suspects a gift was made with continued benefit, it may include the asset in your estate’s valuation for IHT. Executors must provide supporting evidence, such as rental agreements, to demonstrate the gift was valid.

Is it possible to reverse a gift with reservation of benefit?

Yes. You can “release” the reservation by ceasing to benefit from the asset. Once this happens, the seven-year rule begins, and the gift may become exempt if you survive seven years from that date.

How does the valuation of a gifted asset work for IHT purposes?

HMRC uses the market value of the asset at the date of death, not at the time of the gift, to calculate inheritance tax liability.

Does gifting jointly owned property count as a GROB?

It can. If one co-owner gifts their share but continues to live in the property without adjusting occupation terms or rent contributions, it may still be considered a GROB.

Can paying household bills be seen as a benefit in GROB cases?

Yes. If you continue to pay expenses for a property after gifting it, such as insurance or maintenance, it can be deemed a retained benefit and invalidate the gift.

Are there any specific GROB rules for gifting business assets?

Yes. Gifting shares while retaining control over dividends or voting rights can trigger a GROB. Full transfer of control is necessary to avoid inclusion in your estate.

What documents should you keep when gifting assets to avoid GROB implications?

Keep written agreements, rent receipts, valuation reports, and correspondence showing the transfer of benefit. These documents provide crucial evidence if HMRC reviews your estate.